Taxes, taxes, and more taxes. In every country is it horrible to arrange, so also in Germany. Not even expats but also locals have a lot of problems with it. And then you can take the easy way to get the help of a tax consultant, but why don’t want to learn it for yourself? Or in any case, going to try to learn it for yourself. We shall give you some tips and tricks, and try to explain you away through the taxes in Germany.

Where to start

The first step to the world of taxes is to get a tax number, German translation ‘Steuernummer’. After you do the registration at the city hall you get a tax number. When you work for an employer, it will automatically be taken from your salary. But if you are self-employed or a freelancer you need to complete a tax return at the end of each year.

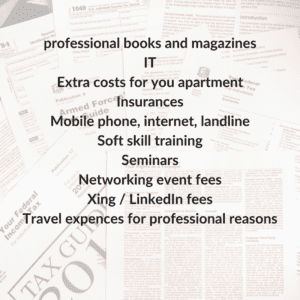

Very important is to collecting receipts of different expenses, because it is possible to get lower taxes from them. The Germans call this ‘Werbungkosten’. This is different costs who citizen can demand their income. And if the income is lower, than it is possible that you pay lower taxes. Below you can see the different expenses.

Different classifications of taxes

But how many taxes do you actually need to pay? And who decides that? Now, your classification decides that. Germany created different classifications of taxes and you know which classification fits you when you see the information below. In German, you call the different classifications ‘Steuerklassen’.

| Class | Description |

| I | Single or separated, don’t fall into either category |

| II | Single and separated with child, entitling them to child’s allowance |

| III | Married or Widowed employees, in the first year of spouse’s death |

| IV | Married employees, both receive income |

| V | Married persons, who normal fall in IV but whose spouse is in III |

| VI | Employees who receive more income, with different work or different tax cards |

Taxable income

So the taxes were only decided about the classification? No, it’s too bad that’s not the procedure. There are more requires deciding how many taxes you pay. The next categories count also for a taxable income.

- Income from agriculture and forestry

- Income from independent personal services

- Income from capital investment

- Income from royalties

- Income from trade or business

- Income from employment

- Rental from immovable property

- Other income

Social Security

In Germany, there is a different way the insurances are arranged. In this blog post you can read more about it, but we will give you more information about the employer at the insurances. Because in Germany is it normal that employer and employee both for the insurances pay. Most of the time it is already demand of the gross salary, so employees won’t notice it. But employers pay for the insurances. They pay the pension insurance, unemployment insurance, health insurance (Expat, Public or Private), nursing insurance.

|

Which insurance? |

Employer contribution in % | Employee contribution in % |

| Health insurance

‘ Krankenversicherung’ |

7,3 | 7,3 – 8,5 |

| Nursing care insurance

‘ Pflegeversicherung’ |

1,275 | 1,275 – 1,525 |

| Pension insurance

‘ Rentenversicherung’ |

9,35 | 9,35 |

| Unemployment insurance

‘ Arbeitslosenversicherung’ |

1,5 | 1,5 |

| Accident insurance

‘ Unfallschutzversicherung’ |

1,25 | N/A |

After Year End

In conclusion, to finalize the tax declaration for the last year you have time until 31st of May if you prepare it yourself or 31st of December if you ask a tax consultant for support. A really good tax resource for English speakers is Meridium, a reasonably priced tax consultancy that offers its services in both English and German.

Finally, just have all collected receipts with you (see above) and your pay slips summary.

Good Luck.